My struggle with e-commerce exports

An in depth details explaining the pain of sellers and non-supportive government.

China’s retail export through e-commerce was 1 Trillion Yuan in 2015 of which 11.5 % approximately 15 billion dollars was B2C.

With the advent of e-commerce in India, sellers are waking up to the possibilities of retail export. It’s picking pace in India. Currently retail exports form a very small fraction of e-commerce. It has a huge potential to grow. This growth has been marked down by age old rules, harassment by government officials and bullying by banks.

Sellers are being forced to do retail exports the illegal way. They sell low cost products ranging from 10-50 dollars. If you export by commercial method, sellers have to pay high clearance charges. Also the amount received on sales will be paid after deducting commission and other charges. There are times when the buyer chooses to return back the product. In such cases sellers refund the amount completely as getting back a product sold through e-commerce is a challenging task. Sellers end up paying custom duty and other charges in order to get their product back. Since no one wishes to go through this daunting task they choose to forgo this money.

The beginning

My struggle began in 2015 when Amazon Global sales team approached me for opening an account on Amazon.co.uk. The option of selling internationally was tempting and I on boarded with them. I inquired them about the documents required and Amazon clearly stated that there is nothing required. They helped me tie up with a courier company called Bombino Express.

Two months down the line I was happy sending my goods to US when I spoke to one of my friends Saurabh and explained about the export that I have been doing. He enlightened me about the requirement of IEC (Import Export Code) and the importance of quoting it on every shipment. Immediately I contacted the courier partner and they stated that since my products were being sent in sample mode this requirement has been bypassed. I was not satisfied by this reply and applied for IEC and quoted them on all the shipments sent.

I had started exporting from July and in February 2016 I approached the DGFT, Kormangala office to get my queries resolved related to e-commerce retail exports. There I found that none of the officials were aware that such a medium of exports exist.

My search led me to Export Policy FY2015-20. The copy that I had in February 2016 just mentioned e-commerce export and MEIS scheme for 5 categories of product. It said that exports should be through foreign post office with a value below Rs 25000. The details were later added in the revised versions of policy. A visit to Foreign post office gave the same results. None of the officials had any details on the export through e-commerce, even though I had a print out of the policy in my hand.

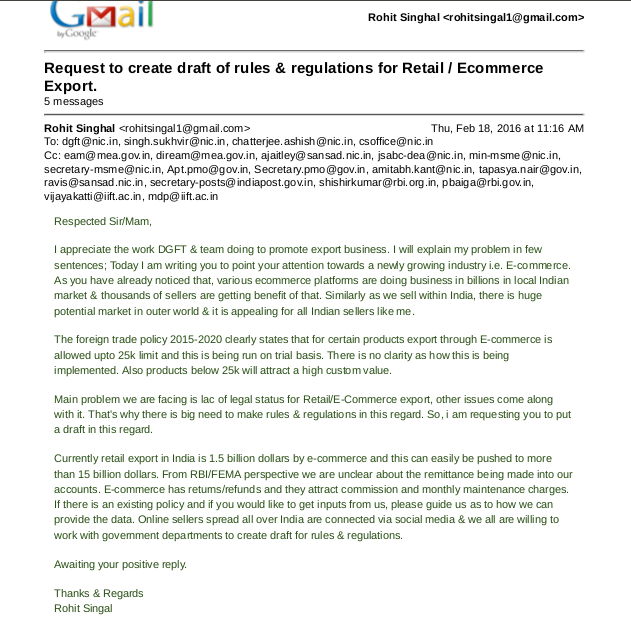

Mails to Government organisation

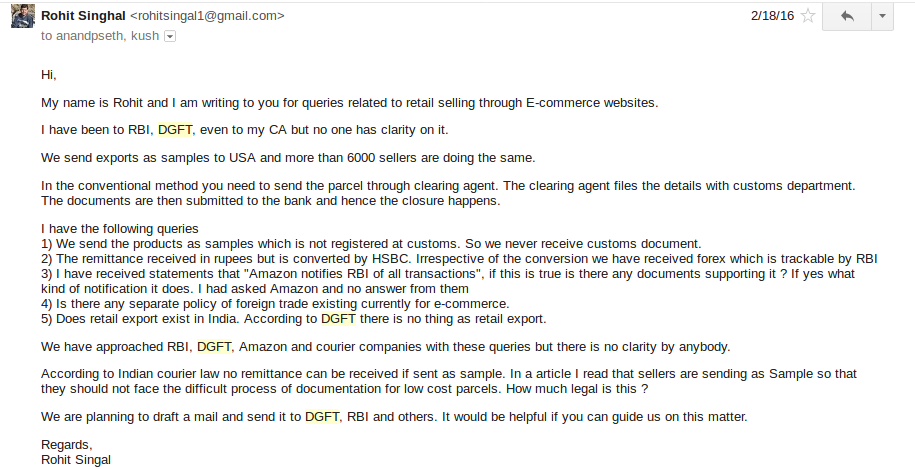

I started contacting various organisation in order to understand the legal way to do an e-commerce retail export (Refer image email-1). Dropped a mail (Refer image email-2) to FIEO (Federation of Indian Export Organisations) and explained the issues plaguing exporters. I had a personal call with one of the members. They accepted the issues, since not many of them had raised the concern they could not take it forward.

email-1

email-2

I was joined by Abhijit Patil who helped me connect with the DGFT team. Together we sent in mails and reminders to understand the export procedure. We were disheartened as none of the agencies responded with any details.

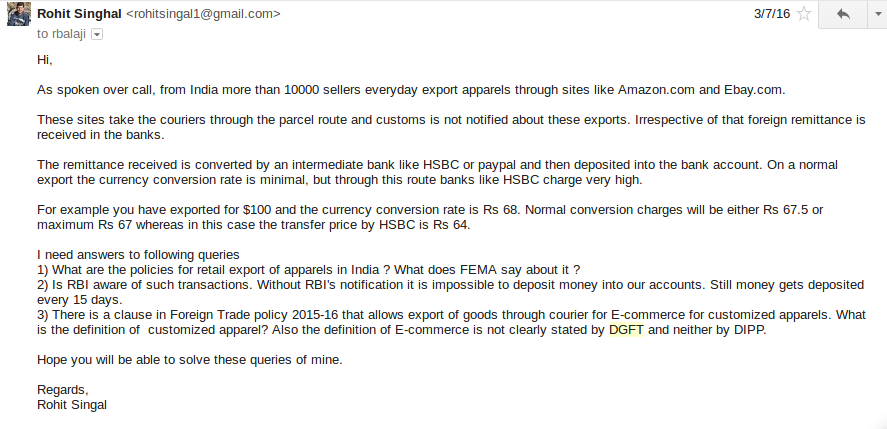

By March 2016, being an apparel exporter, I dropped a mail to R Balaji of APEC India (Refer image email -3). I wasn’t expecting any response and I was right. Tempers and frustrations were running high. Up to this point nothing was clear on the export policies. On 15 March 2016, I dropped a mail to all the departments combined (RBI, DGFT, DIPP and others). RBI contacted me stating that the queries can only be handled by Foreign Exchange Department. That’s when I came in contact with Sakshi Parihar.

email-3

RBI Answers

She helped me with few queries related to compliance of export. As per her statement the export procedure followed by us was correct except that the products cannot be shipped as samples. I explained her the high costs involving with commercial exports. The courier law clearly states that no remittances can be received on sample exports. She also put me in contact with ParmeshwarNath , paypal head.

On contacting Parmeshwar I found that ebay has been fighting similar battle from a long time. All payments through Paypal are routed through OPGSP (online payment gateway service provider). This ensures that all payments received for products sold through eBay meet RBI compliance. You can refer to eBay RBI issue where eBay was banned for few months from selling online as payments received were in dollars.

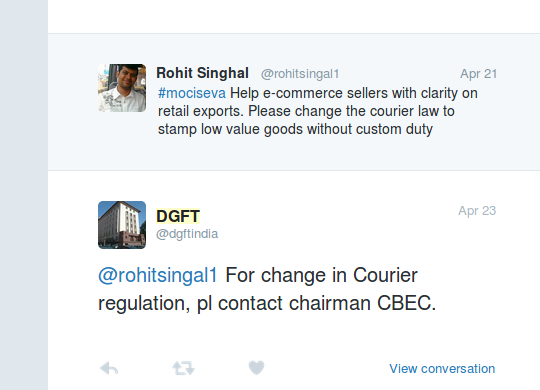

In April since none of the government authorities were responding, the issue was raised with the PG portal. Find the response in image. Even a tweet to mociseva was received with an answer to connect to another department (refer image tweet-1) .

Bulk Shipment issues.

Since there was no answer with any department I gave up and focussed on my business. In July 2016 I started sending bulk shipments to USA. This opened another can of worms.

All shipments sent to US FBA warehouse are treated as sales and a Sales invoice needs to be raised. Indian government does not have any rules for international stock transfer.

Sending a bulk shipment involves realisation of transaction against the export that has been made. In order to do so you need a Foreign inward remittance certificate (FIRC). This document ascertains that you have exported and that the remittance received is against it. This has to be attached with Exchange control copy of customs and submitted along with MAWB (Airwaybill), Invoice and Packing list to your bank. The bank will then realise the export thus generating e-BRC. The realisation date is within 270 days of export. You need to apply for an extension with your bank citing valid reasons.

Export is a highly regulated process. You need to comply with all the rules of RBI (FEMA) else the consequences involve severe legal issues. There are sellers who are behind bars for failing to comply with such laws.

I wasn’t aware of the facts mentioned above. To start off I just applied for FIRC with HSBC bank as Amazon routes all it’s international payments through them. HSBC takes it’s own time to respond. For an application sent in July 2016 they came back with a response in September. With the new FEDAI circular FIRC’s were no longer issued. I received inward remittance details from them.

When I approached my bank with the details, they stated that since the amount received was in rupees and the export was in dollars, it cannot be realised. I contacted Sakshi and she sent me letter explaining how through EDPMS banks could realise the transaction in other currencies.

E-BRC and success

Once again I approached the bank with the new information. They reluctantly agreed to work on it but said I need to give them the inward remittance details of HSBC. Since I had remittance details till July 2016 only from my previous correspondence, I needed details after that. So in December 2016 I applied for the remaining transactions that is from July to December. HSBC responded after 20 days stating they needed transaction details. These details are found in the banks inward via NEFT. To get them one has to check all those dates on which a remittance was received and write them down individually. This consumed another 20 days and we were almost at the end of February 2017.

After sharing the details HSBC did not respond. As a result I raised a complaint with banking ombudsman. The copy of the letter was attached and sent to HSBC who replied within a week with all the transaction details.

Finally all the details were ready but another challenge remained. The amount received in rupees was not matching exactly with the shipment sent. In a normal export the amount exported against an Invoice will receive a payment equal to the invoice raised. In case of Amazon’s export there are times when you receive more or less payment for a shipment sent. For example if you have sent goods worth 1000 dollars you might end up getting 900 or 1500 dollars as payment. Also Amazon does not provide payments against Invoice numbers that has been raised by us.

There is also an uncertainty at what value the goods will be sold in the warehouse. There are times when you need to destroy them. Since there is no invoice to invoice payment realisation becomes difficult.

For this a solution has been provided where banks can realise them partially and generate e-brc. So finally they were able to close the transaction and e-brc was generated successfully.

Highlights

I would like to highlight few important points

1) Amazon’s Global selling team blindly on boards sellers. Make sure you know the details and pitfalls of selling internationally.

2) Amazon’s Global team also misguides seller’s intentionally. Check with fellow sellers before believing their statements.

3) HSBC still continues to ignore sellers request for inward remittance. Many sellers have applied through their banks but no response received. It’s better you apply early so that the time-line for realisation is met.

4) There is still no clarification as to how Amazon transfer’s money to India. A complaint has been made to RBI in January for which response is pending. Also a mail to Jeff and Amit gave no results.

If you have been exporting through Amazon and would like to know whether you are in trouble with RBI. Visit your Forex branch of your bank and ask them to check your IEC in the caution list. If you are in the list don’t worry you still have time to rectify this.

There are lot more things that this article does not cover. I will try to answer them in subsequent ones. We maintain an International whatsapp group but that’s running full. In order to get quick answers to queries on International selling you can join the ECSAI.org telegram group by registering on this link https://goo.gl/vxfKkX

Would you like to submit an article. Fill the contact form here

This is an eye opener. I have just signed up with ebay.com a couple of days back. They Ebay exec told that only PAN number is enough to start exporting in retail. I have not listed my products still, now will have a 2nd thought whether I should start doing it also or not.

Nothing is more worse than landing into trouble with the government agencies because that will suck every drop of blood left in your body. I would rather stay away than getting lost in this Labrynth.

Thanks Rohit for sharing your knowledge with us. Good luck with your fight with these guys. Pls do let me know if I can be of any help.

I’m a seller from Chennai.

Cheers!

Ebay is more organised and follow all regulations. They are registered with OPGSP. You can go ahead with them. The above issues are faced when you do bulk shipment which ebay does not offer.

I have been selling on eBay for last 10 years now. Unfortunately, eBay doesn’t have any clarity whether the Equalization Levy is to be paid by the sellers on the invoices raised by eBay or not… eBay bluntly says NO Equalization levy but fails to provide any details whether this information has came from the Income Tax Department or it is their own assumption. Also the TDS issue related to eBay invoices remains unresolved.

Hence after eBay has become a Singapore based company and doesn’t have an Indian PAN and GST, it has become a very uncertain company in terms of following regulations in India.

This is my belief about eBay in current scenario. I am not forcing these on anyone.

Mustufa Baldiwala

eBay ID: real.phoenix

Hi Rohith,

Thanks for the Article. Pls add me into the group.

Dinesh R – 7418257621.

Actually We are shipping into Amazon FBA shipments into US for last 1 year. At initially (1st invoice) we sent value $44400.00, on May 2019. after that we had sent 10 Shipments to Amazon, US. Value around $ 85500.00, as of now we have received payment $13,800.00 only, still my 1st bill not closed. and we have $38,000.00 for Advertising, Promotion, Amazon Fee and other Fee. And also we have received SB outstanding list from RBI. So please suggest me how to close SB.

Hey Rohit. Thank you so much. For this knowledge.

Was going through same.

I am using dhl and they also doing one new thing they ship courier from India to usa then through border canada and charge additional 17.5$ in name of custom fees + dutys extraa.

Want this problem to solved.

Kindly add me to the group

+91 9099646700

That is a tough fight

Rohit, first of all thanks for the detailed article, it is brilliantly analysed.

One query here though, what is legally wrong here if one doesn’t want any remittance benefit, he ships product as sample and receive payment in bank accounts in rupess.

Thanks

Visual e-brc is applicable only for bulk shipments. For individual in sample mode you can continue.

Rohit, the seller would still be paying Sales tax for an item he has exported in this case. Not to mention if he receiving payment for a sample, it is against the laws and would subject him to action by DGFT, and may be under FERA too. The simple thing for the government to do is set up a eCommerce export division which regulates small retail shipments.

Things have changed. Sample/courier mode is accepted after foreign trade policy of 2015-20. In another 2-3 months the government is going to capture all details in EDI.

Hey rohit, congrats on finally succeeding in closing a transaction and also thanks for opening door to export(in legal way) for many small sellers… great work

Wow mr. Rohit you did a great job, i analysed your situation & found many situations where i also landed but i ignored them i started in early 2005 this via eBay & paypal got IEC most of the payments were via Paypal as my paypal was linked to my C.A/C & many times i get a cheque via post as well but my Father got expired in 2007 who was the owner prop of that co. & i also shifted my focus from export to local indian sites in 2009 onwards

But suddenly there was no option to change PROP IN PAYPAL i tried to open a new ac a new prop my brother. But all got rejected all my accounts got in Pending state resulting no payments & from past 5 years we got shift to domestic sales but Ebay & paypal are now not in a tieup also i approached amazon.com but there is no reply .

Kindly connect with me as i am also very much upset by these methodology there has to be solloutuons for these problems

can we form a whatsapp group ? I am sure many of our issues are common –

Rohtji this is just the start of your troubles.

We have been exporting since 25 years now and I am personally looking after compliance since 7 years.

Now wait for the attack of the babus.

Start expecting letters from DGFT, Customs and RBI asking you for paperwork on how u got BRC, explanation for settlement of more or less funds received against shipping bill.

In DGFT it is known as scroll and you will be able to track your scroll by entering your iec on dgft.gov.in

Everytime they open the scroll, u have to do the same paperwork over and over again in a inebound manner.

Unfortunately this is how the system works.

I am exporting via Amazon.com for 9 months now – Just got approached by a babu – wants to check on the original papers of my office ownership !! Original electricity bill in my name will not do – Got to see what this is all about.- Delhi Customs

I think it is not allowed to export samples through courier mode and get remittances. The declaration that is signed under the courier mode will land you in trouble if any foreign exchange remittance is involved. Leave alone any benefits that you are entitled.

@Mr.Rohit, FIRC is still being issued for remittances which involve service exports and the circular issued by RBI for issuance of FIRC is still not rescinded. I dont think FEDA’ s guidelines gains legal importance and it does not have a overriding effect on a RBI circular. Declaration for remittances is exempt under RBI rules.

Correct me if I am wrong…..

I agree to your point that I cannot receive remittance against samples. Then again the Foreign trade policy 2015-20 clearly states that export under courier mode is allowed for e-commerce. I have raised the query with customs as these are two contradictory statements.

Whenever I have spoken to RBI they always state the FEDAI circular for FIRC. It does not matter much now since the inward remittance details is equivalent to FIRC and few of us have been able to generate e-brc. I am not aware of the exemption of remittance declaration. Drop me a mail at contact@ecombites.com and share your contact. I need to talk to you.

Mr.Rohit, You have missed an important qualifying word in the Foreign Trade Policy which states that courier exports are allowed as per Notifications of DoR. Specific provisions prevail over General provisions.

Could you share more details on this.

Hello Rohit

Read your story, would like to know more about the procedure.

There is really close to no info on this online.

Can you kindly add me on watsapp.

Share your number

Love this post Rohit – what you have done till now – I would like to be kept abreast of – Can we talk on whatsapp or phone ?

Rohit – I am in the exact same situation – got to get the remittance details from HSBC – who in HSBC should I write to – where do I send the email ? I need my bankers to create the E-BRC against my remittances to fullfill the compliance noms. Please let me know the email address where I can request HSBC to give remittance details of my amounts received. I have a list of all amounts received.

We already have a WhatsApp group. In fact the group is almost full. We maintain another group under ECSAI.org. I am online in these groups all the time and try to resolve seller queries. You can register with us by dropping a mail to contact@ecsai.org

If i have an account HSBC And getting amount from Amazon to HSBC account .how to get firc and e-BRC gets clear

FIRC is no longer issued. To get e-BRC you need to get the Inward remittance details from HSBC. Connect with these guys at indianexportspn@gmail.com they will help you out.

which branch will provide Inward remittance details. Mumbai Branch or our local HSBC branch

Hello All

We are in similar line of business. Looks like GST will make it tougher for us to do business as we will be required to pay IGST on sales invoice. The amount will be refunded to us on submitted custom docs which we won’t have. Thoughts??

Hi Rohit,

Reading this felt like I had written this. Same challenges, same frustrations and going around in circles. In addition, FIRCs issues by CItibank to my ICICI branch were rejected since the remitter was mentioned as PayPal in all cases.lol.

And many of my small export orders were paid via PayPal where in the person/company on the Shipping Bill did not match the one who paid – did you face any such issues.

Next week the new Foreign Trade policy is coming out – I was told by an agent.

I feel we should seek a “green channel” export clause – where by one exporting through such a method says I don’t want any charity from govt and in return I only need to update one site (RBI) with inward remits. Dropping you an email to add me to the Whatsapp group.

Look forward to connecting with you.

Regards,

Samraa

Yes by June 30 the revision of foreign trade policy will be released. Waiting eagerly for it. As for RBI, Custom and DGFT goes even RTI on them did not yield any results. I will add you to the group.

Thanks Rohit – look forward to seeing what other guys are struggling with! Seeing your attempts, I feel re-charged to take my issues head on 🙂 Hope they improve things in this review, else we just hand over everything to China.

Hi Rohit ,This is Rishu Jain,Seller with amazon.in , Thanks for sharing this valuable article regarding global selling.I wish to join the WhatsApp group ,my nbr is 9810179761, please add me

Hi Rohit,

I am an employee of FEDERATION OF INDIAN EXPORT ORGANISATIONS and feel really sorry that you queries was not resolved in first place. I may state here that if you require any help from the Federation regarding E-Commerce Exports and getting your BRC from AD Banks, FIEO is at your disposal always. We shall be more than happy to to help you.

Thats what FIEO is all about.

If any of you are facing problems in procuring BRC from your AD Banks for your exports done via E-commerce & payment received via OPGSP (paypall etc.) kindly contact FIEO for assistance.

Hi Vishvaditya,

What email shall we write on? Or is there a toll free number?

Regards,

Samraat

Hi Sanraat,

You may contact me M: 8586877982 @: vishvaditya@fieo.org

L: 011 46042149

Thanks! Will email you.

Thanks. Great post.

Hi,

I have a query related to bill of lading.

Is BILL OF LADING a compulsory documents that one has to give to the auditors to file the returns on exports.

I also understand that amazon does not give this document. Henceforth, what is the procedure and the way around the same.

Thank you

Quite a read!. All the best with your fights with GOI. I am curious, whether similar thing is being done for ecommerce imports too?. On eBay Global Buying & Amazon Global Store?.

I was going through all the posts its was mentioned that a new foreign trade policy is due by June 30. Does it came through? Any respite for e-commerce exports? We were told that we need to pay IGST on our export sale and then the same needs to be claimed. But we are not sure whether the claim departments will consider this as EXPORT?

Hello,

I had written a similar post regarding these problems & especially after GST would appreciate if we all can resolve it .

http://www.caclubindia.com/experts/ecommerce-exports-digital-imports-under-gst–2549344.asp

Check this – it elaborates about the CSB-5 S.Bill which is expected soon and would get all of us out of this toxic sarkari mess.

https://caclub.in/courier-shipping-bill-in-new-form-csb-v-notified-by-cbec-replacing-csb-ii/

Hi I got letter from fedex for MEIS credit for commercial shipment if I follow that then i have to right full price then many of my parcels will not be accept by buyer’s because they not want to pay taxes locally please help….

Any resolution to the retail exports

Yes finally we do have a solution for retail exports. The solution is currently in infancy stage and being rolled out to sellers across India. You can join our whatsapp group to get updates on exports plus get your doubts cleared from other sellers as well.

Hi Rohit,

I am a retail exporter as well and I am far more confused with these export procedures. I would like to join the whatsapp group for updates on this new bill.

Also is there any clarification yet on whether or not we will be required to pay IGST on all our sales? Also, do we need to get shipping bills from exice for all our shipments?

Thanks

hi rohit

how to join your whatass group. My phone number is

Hi Rohit,

Please add me to your WhatsApp group. My phone number is

Hi Rohit,

Please add me to your WhatsApp group. My phone number is.

hi rohit add me in whatsapp group

my phone number is 9313034314

Hi Rohit,

I sincerely appreciate your stupendous efforts to highlight the pains and troubles that this lucrative Retail/E-commerce exports industry is suffering from due to the ambiguous policy,

I am keenly wondering whether you have any update on the solution to retail exports that you mentioned in one of your comments is going to be rolled out,

Please add me to your whatsapp group, my whatsapp number is +91-8564878398,

Please add me to your WhatsApp group. My phone number is 9868841685

Hello Rohit

I am sailing in the same boat. Please add me to your whatsapp group. (my mob no is +91-9878668822)

I have also sent an email contact@ecsai.org

Hi Rohit,

Please add me to your WhatsApp group. My phone number is

This post is worth everyone’s attention. When can I find out

more?

please add me to the group as me too sailing in the same boat

if we send single item export goods through indian post , in this case ebrc and firc is necessary , becuase my axis bank said ebrc cannot issue on india postal receipt without proper shipping bill.

Yes your bank is right. On Indiapost shipping bill it’s difficult to provide an e-brc for individual shipments. Currently we have CSB-5 for individual shipments in courier/sample mode and courier service like DHL are providing shipping bill for them. You can get e-brc using CSB-5 shipping bills. For more info you can join our group

rohit i read on dgft site we can get postal bill of export for maximum 10 transaction ( one bill is enough )from foreign post office as a shipping bill , is tht right ?

9313034314 my number add me in grp

Hi rohit saw the article few months back was not having idea about the group can you please add me too my mobile is 9879574372

regards

devang

Added

Hi can you please add me as well 8879529525

Hi Rohit ,This is Rishu Jain,Seller with amazon.in , Thanks for sharing this valuable article regarding global selling.I wish to join the WhatsApp group ,my nbr is 9810179761, please add me

Hi Rohit,

Thanks for sharing this valuable article regarding global selling.I wish to join the WhatsApp and telegram group ,my nbr is 8285616001

Hi Rohit,

Thanks for sharing this valuable article regarding global selling , I wish to join the WhatsApp Group ,my nbr is 8285616001

Rajesh

Hiii Rohit ,

Your information is very Useful , I am also a Retail Exporter, Please Add me to your Whatsapp Group.

My mobile Number is : 8221978999

Add me to your group

Add to group 9351105322

Hi rohit, it’s an interesting read and am interested in knowing more on the same as I am into the logistics business. Please add me to the group. My number is 9819908845

Hi ROHIT

this is ADISH JAIN, i am a seller on eBay.com since last 5 years and have been exporting goods across the globe. My firm is almost three decades old and we are into exports primarily. Kindly add me into your Whatsapp group as i am too facing lot of problems of shipments exported for payments received through PAYPAL. My number is +919999899885

Hi rohit saw the article few months back was not having idea about the group can you please add me too my mobile is 9997879729

please add me to watsapp group my no. is 9997879719

Hello Rohit,

Please add my watsapp number 9935150623 as I am also a Retail Exporter and facing lots of issues of compliance of Retail exports with GST regime.

Hello rohit,

Please add my whatsapp number 7737698891 as i am a FBA seller at amazon.com and want to know how to work on commercial shipments and GST

Kindly add me to your WhatsApp group Number 9840862466

Thanks for sharing this valuable article regarding global selling.I wish to join the WhatsApp and telegram group ,my nbr is 7287937870

Please add me too 96-545-21-451

Please add to the whatsapp group, very important, my bank has hold the remittance Ph-96-545-21-451

Please add me to your WhatsApp group Number 9851241751

Hi rohit saw the article few months back was not having idea about the group can you please add me too my mobile is 8879529525

Hello, this is Nitin and we are planning to shift our online business from USA to India and wanted to know all about the govt norms to follow. it seems there is not much help from them on this. and its a pity as we could have taken over in retail exports as China is doing with there govt helping them with shipping to the USA on subsidized rate of just .40 cents per epacket.

Hi Rohit

Pls add me to the group

+919908616762

Kindly ass me to the Whatsapp group. I am working in e-commerce in Ebay and Amazon from last 7 years . Had done some homework with PayPal FIRCs in last 1 and half year . After a long struggle will be obtaining FIRC from PayPal in 15 – 20 days. Will keep posted

Please add 9780485865 to whatsapp group

Kindly add me to the Whatsapp group. I am working in e-commerce in Ebay and Amazon from last 7 years . Had done some homework with PayPal FIRCs in last 1 and half year . After a long struggle will be obtaining FIRC from PayPal in 15 – 20 days. Will keep posted

Please add 9780485865 to whatsapp group

Please my number +919510308415 also regarding to solve this big issue.

Hi,

Is it possible to share HSBC email Id as we have to get FIRC for the payment sent by Amazon via HSBC.

Please help us out.

Hi Rohit ,

You have litterally explained the problem of all the ecommerce exporters and small exporters also.

There are so many things now which is in transition phase as compared to the cases like 2 years of 5 years back. We are also getting issued the eBRC’s for all of our transactions and for sample mode shipments we dont have any information. Actually the service provider says that whenver you send any bill then keep it under 25000 for not stucking it with customs and it wont be cleared with custom procedures and we then make then undervalued and get it bypassed. There may be many friends who has been doing this thing.

The issue of BRC with inr payment is also valid. i also wrote to Paypal and also suggested them to start any system in which customer pay the FIRC charges and you issue the FIRC to their bank address and i am sure there would so many other who supported and suggested the same issue and Paypal has incorporated this in to their system. I dont know about other services. I also use some smaller payments routed via Transferwise and they have tie up with HDFC and YES bank in india. They both issue FIRC but actually no one issues FIRC, instead a debit /credit advice stating the information of the amount they recieve with rupee exchange settlement in their Nostro Vostro bank accounts.

i also want to get join in your whatsapp group, my number is 8905944414.

Rohit do you have any idea as how your bank clear the transactions when you show the FIRC without the usd details i mean with the INR details because there is the system in place by RBI after 2016 and also according to FEDAI , there will be no FIRC issued except FDI and FII.

can you put some light. i have SBI as my banker and thy are not clearing my exports bill and i have complained everywhere and no one in sbi seems to be knowledgeable to solve this matter. Thought it is very simple as per the FEDAI Circulars the recipient bank has to report the transaction to EPDMS and their on they can generate the OMO no and IRM no and AD bank code then only they can clear the transaction against the bill.

Hi Rohit

Your article has nailed the problem on its head. I want to start selling on Amazon global and now bit worried about the legality of the whole business transaction.please add my number 9810292843 in your Watts app grou

Yes finally we do have a solution for retail exports. The solution is currently in infancy stage and being rolled out to sellers across India…Rohit what is the solution for Retail Export through Amazon US and receipts through PAYPAL

Rohit thanks a lot for the info.

Im sure there are many developments on this after youve posted this.

I have recently started receiving payments from amazon.com to my bank via hsbc mumbai

Amazon says HSBC mumbai sends the info of txn (like purpose cose and reference number) to my AD bank.

My AD bank flats refuses that they have not received any info

Question: How does HSBC send the info. is it by mail or by SWIFT systme?

Please add my number 9890277762 in your whatsapp group

Hi Rohit,

You have really done a phenomenal job by highlighting the pains and struggles that the ecommerce export industry in India is suffering from due to lack of clarity in this regard,

I am just wondering if they have recently come up with any proper guidelines pertaining to shipping and payments, if so, please do bring to our notice as well,

we have been in E-commerce export for past sometimes, and it is really pity that there is still no unambiguous clarity regarding this, while it needs to be taken care of on priority basis in order to tap the immense potential that exists in this industry, while the china is doing pretty well with the policy being very clear there,

I humbly request you to please add me in your whatsapp group, my number is +91-8564878398

Hi Rohit,

This was a great article.

We are also in the same boat as your. We have been sending bulk shipments to Amazon in US,UK and Canada and receive the remittances via HSBC. HSBC is not issuing any customer advice / e-FIRC to us for transactions done after June 2016. They are saying that only my bank ( ICICI ) can issue these as per some RBI circular.

Now, we are facing a VAT audit for FY 2017-18 and don’t have FIRCs to support our exports.Could you please let me know if there is a way out of this. We have been in constant communication with ICICI and HSBC but there has been no success.

Also, if you could please add me to your group so that I can get latest information on this subject, that would be wonderful. My number is 9902488008

Thanks again for writing this.

Good day!

~

Manish

Hello Rohit

I am in retail ecommerce Export

please add my no in whats up group my no is

9911409900

Hi Rohit

You mentioned in your article, “There are sellers who are behind bars for failing to comply with such laws.” If you could please share some details about their firm’s name, we can further investigate. I am studying the legal cases on e-commerce sellers for past 2 years. Please forget any differences with me. If you could share these details, I may be helpful to them. If wouldn’t be suitable to share these in open platform. If you could send any link on my phone number (with whatsapp) or email ID attached to this message, I can check their case and try and help.

Kind Regards

Mustufa

9898 787 357

Please add me to the whats group. I am a retail exporter. My number is 9839086495

hi rohit pls add me in the group my numbver is 9830148811 i am also facing lot of difficulties

Hi Rohit, Thanks for sharing your experience. Please add me in the group my number is 8851975299.

Hi Rohit,

This was a great article.

We are also in the same boat as your. We have been sending bulk shipments to Amazon in US and receive the remittances via HSBC. HSBC is not issuing any e-FIRC to us for transactions done after June 2016. They are saying that only my bank ( Union bank) can issue these as per some RBI circular.

Now, we don’t have FIRCs to support our exports.Could you please let me know if there is a way out of this.

Also, if you could please add me to your group so that I can get latest information on this subject, that would be wonderful. My number is 8080007165.

Hi kindly add me to the whatsapp group. My number is +919811996367

Pls add me in the whats app group, my number is 978487878. I have stopped ecommerce worldwide due to same reasons. Its so complecated. Kindly help.

Your phone number is incorrect.

hi Rohit,

Very informative article. I am undergoing a second similar topic.

I am in retail ecommerce Export

please add my no in whats up group my no is

9911409900

Hi Rohit,

Thanks for this post.

Could you please add me to this group as well. I have similar issues and wanted to discuss. 7030819900.

Hi Rohit,

My name is Manoranjan. I am an eBay employee and i must say there are lot of things i was not aware of & came to know going through this post. Kindly add me to WhatsApp group so that i may get the updates shared and can guide the sellers i am managing.

Thanks.

7319966135

manorkumar@ebay.com

Hello. Can I also be added to the group. 9986531003. Thank you.

DO U KNOW ABOUT CSB-5

You can join my WhatsApp group for all export related queries. Share your number

Can you please add me to the group +91-7503756876

Hi,

My number is 7700917627

8500909778 add me in to whatsup group

Please add me too – 9811745155

I am having the same issues and I wish the government will improve the export regulations in order to sustain small businesses like us. My shipments were returned by the custom at Delhi 3 times because they said that we did not declare the shipments as samples and we need to process them as commercial. But knowing the problems with Forex and remittance from Amazon in INR, I know that we will get into problem with RBI. Please add my number, my name is Rajnikant Gaikwad 9748152866. I hope as a group, we can find a solution to the problem and hoping Indian sellers will do better in ecom export.

hi,

please inform what purpose code should we use for inward received thru payoneer for payment received for FBA AMAZON shipment.

pls add me in group 9811099198 neelesh

Hi,

Kindly add me on watsapp group. My number is 9555970267

Please add me 8285616001

Hi Rohit,

I can relate with the problems you faced regarding Bank realization for Amazon FBA export shipments. I would love to get some insights and valuable information from your WhatsApp group. Please add me 9022590176

Issues getting EFIRC from HSB. Please add my number to the groups – 9980088559

Please add me 7073734666

Hi Rohit,

Pl add me to the watsapp group

Share your number

6397847421

Hi Rohit

We are still facing a lot of issues regarding the same even after csb-v as our products are between 10-50$ only. Kindly add me to the whatsapp group. My number is 9971267823

Hi Rohit,

Firstly you are awesome. You made it through which was great.

I am having issues with my banking charging around 1500 to knock off Open shipping bills. This is too much for getting BRC. Need some help could you please adde me to your Whatsapp Group 8097135113.

Thanks in advance.

Hey Rohit,

You fantastic you story is really helpful. Recently i have started my business bank is charging too much to knock off payment of SB

Could you please add me into your group i really need a forum to discuss. Please add me suraj 8097135113 i have started amazon fba USA i live in Mumbai.

Please add me in whatsapp +91 8277083962

Please please add my whatsapp +91 8277083962

Please add me in the WhatsApp group-9599560693.

& Please tell me the real truth if something has changed after govt empowering export as now e-brc is free from sbi !

please tell i am new exporter and want to know the truth about hidden charges, penalaties etc!

Please add me in the WhatsApp group-9599560693.

& Please tell me the real truth if something has changed after govt empowering export as now e-brc is free from sbi !

please tell i am new exporter and want to know the truth about hidden charges, penalaties etc!

PLS ADD ME 9997009357

Hello, I’m Veeresh.

I got this email address from you comment in one of the blogs. Your help matters me a lot.

While transferring stock to international warehouse located in US, what should I we declare in the shipping bill? Because we still don’t know exact proceeds as eCommerce facilitator will deduct their fees and shipping. For example, if we receive 150$ as sales proceeds where we declared in shipping bill as 100$ which is our cost price. How to deal in getting realisation certificate? or any way how every sellers deal with this situation?

Your help matters a lot in my future exports business life…

Thanks

Hi Rohit,

Thanks for publishing such an informative article and I totally relate with the problems you’ve stated and I am in the same situation at this point of time.

I started my USA FBA business 6 months back.

Please add me to the whatsapp and telegram group – +919999334664

hello rohit,

thanks for this helpful article. there seems to be almost no information regarding such issues faced by exporters who are using OPGSPs likes paypal to get paid for the exports they are doing. banks charging extremely high ebrc charges from me to the point that it almost matches my export bill amount. this is no way sustainable for me.

please add me to the whatsapp/telegram group- +918981581611

Hi Rohit,

I have started a eCommerce business which is going to ship products worth $50-60 internationally mainly using CSB-V. My payments would be coming through PayPal for which they would be issuing me FIRC. But my banks are charging me a lot for issuing eBRC. Is there any legal way out of this?

Please add me to the whatsapp and telegram group – +918981581611

Sir please add me to your WhatsApp group, i have many questions and have started export business 2 Y ago

Hi Rohit

Please add me to the group

Facing issue with CSB-V cleared shipments now bank is asking for Rs 1000/- per SB and on older shipments Rs 2500 PEr SB

Share your number so that we can have a discussion on it.

Please add me in group 8210308091

Hi Rohit

Please add me to the whatsapp and telegram group – +919429239653

Hi Rohit,

Thank you for providing such a great and valuable information. We have pending shipping bills to be realised and already 6 months have been passed.

Our AD Bank – ICICI Bank says that Remitter name and Receiver name is not same and refuses to close the shipping bills.

We are receiving inward remittances from a marketplace named Texinkart (like amazon) from USA.

Urgently need your help in this regard, Kindly support. Our whatsapp number is 9444151180

WE ARE EXPORTING ALL EXPORTS BY FORIEGN POST OFFICE AND CSB5 .BUT STILL BANK HAVE NO DETAILS OF IT IN EDPMS OR OTHER PLACE . .AND IS IT MANDATORY TO CLEAR THESE EXPORT BILLS OF RETAIL EXPORTS OF 10-100 DOLLARS .. CAN ANYONE ADD ME TO A GROUP WHERE WE CAN DISCUSS.

Hi Rohit,

I am about to start my journey of Amazon US FBA and have same questions in mind which you had faced.

Thanks for sharing your experience.

The solution I found for the bulk e commerce export is , opening a company in US also, send the shipment on that company’s name , price we can put on invoice whatever we want, transfer that invoice amount from the US company to indian bank account in USD than we can easily close the SB with our bank.

And run our Amazon business with that US entity.

This is a bit complected and costly option though, if you have found any other simple option for this problem than please do let us know !

(Please add me also if you have any WhatsApp or teligram community)

Thank you !

Ashhadul Islam

9890403151.

Hello Rohit,

Incredible work by you. And I can imagine the pain you would have had going through all of these in 2015-16 and it seems nothing much changed over the

last 5-7 year or so. We are having the same kind of pain from the customs department, bankers, PayPal and GST office.

The clarity with respect of CSBV is still missing and different sections have different experience.

For last many months I have been struggling to some clarity on the subject and have discussed with many guys I thought would have right knowledge but failed. I am glad that finally landed up in your blog which is ditto of my problem and much much relatable.

Is there a way to speak with you and understand what latest you have found and if I get a chance to take input from you about the problem that I have.

Looking forward to hearing from you. My phone number is Nine Seven Zero Four Four Five Six Six Eight Three.

Thank you so much.

Regards Anurag

Hi Rohit, We are unable to close Shipping bills because SBI bank are charging higher amount to close the shipping bill. Can you please add me in group 9029374449

Hii Rohit,

I am having similar problem so what did you do to resolve it