TDS Calculation and Payment

In this post I am going to discuss on the procedure to calculate and pay TDS for Indian e-commerce websites like Flipkart, Amazon and others. Please refer to this wikipedia article in order to understand what is TDS

From e-commerce perspective the following are liable to deduct TDS

- Any Individual/Proprietor who was under first year of audit in the previous financial year is liable to deduct TDS.Currently from 2016-17 any Individual/Proprietor who has a turnover of Rs 2 crore and shows 8% nett profit is not liable to be under audit. For last year i.e 2015-16 the limit was 1 crore. So if you have crossed 1 crore turnover in the last year as an Individual/Proprietor you are liable to deduct TDS from this year.

- For Companies like Private Limited, LLP, Partnership Firm and Public limited TDS deductions are from day one

You need to pay TDS within 7 days of Invoice generation. Most of the e-commerce companies generate their Invoice on the last day of the month, as a result you are liable to pay TDS on or before 7th of every Month. Flipkart, Amazon issue it by 3rd or 5th of every month but the Invoice date is always the last date of the month.

TDS filing happens every quarterly and the time for filing is by the end of the quarter month. This date changes from year to year and can be searched on google by typing “TDS date filing for current year” . For example this year for first quarter from 1-Apr-2016 to 30-Jun-2016 the last date of filing is 31st July 2016.

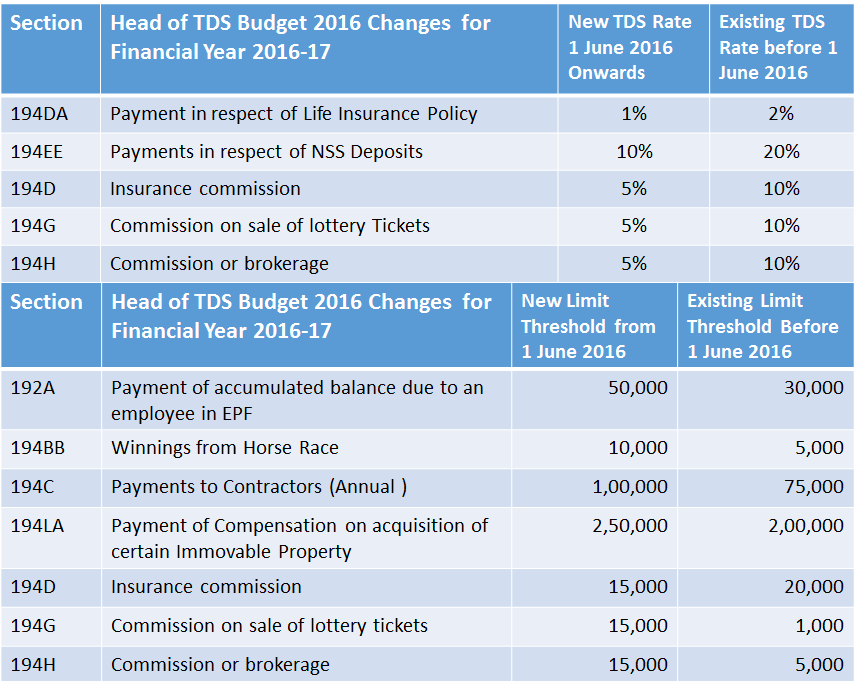

What is the TDS percentage that we need to deduct and pay

Please refer to the link here to understand the different percentages that you need to deduct for various sections. For e-commerce sellers only two section are of importance

- Section 194C: Payment to Contractors/Sub-Contractors. This section is for deduction of courier charges/Shipping charges since courier partners are our indirect contractors. Though the section says that for Individual the deduction is 1% we deduct 2% for all Invoices.

- Section 194H: Commission or brokerage. Since e-commerce websites are like commission agents we are liable to deduct TDS on the service provided by them. So in your Invoice apart from Shipping charges (Section 194C) all others will go in this section. For example commission Fee, Collection Fee, Fixed Fee, Marketing Fee and others will go under this section.

Please Note: All Invoices generated till 31-May-2015 attract 10% TDS and after that 5% TDS.

What is meaning of threshold limit

As seen in the image for Section 194C the limit is Rs 1 lakh (From June 1st) and 194H Rs 15000 (From June 1st). The threshold limit is given by the government just to define a limit beyond which TDS is compulsory. It also gives you additional time for payment in case you have yet to reach the limit.

Lets take it with an example.

Assume in your Flipkart invoice first month (April 2016) commission fee is not more than Rs 2000 then you need not pay TDS. In the month of May 2016 the commission is Rs 3200. Now the total commission fee is Rs 5200 for two months. Since it is crossed the limit of Rs 5000 (Remember up to 31 May 2016 limit is Rs 5000 after that 15000) you are liable to pay TDS on Rs 5200 totally. Some may argue that since it is just Rs 200 above the threshold limit of Rs 5000 so TDS is applicable only on Rs 200. That is not the case. Please remember that this is threshold limit and not exemption limit.

For 194C also if the courier fees does not cross 75k (before 31st May) you can choose not to deduct TDS but if it crosses that limit you need to deduct TDS from the first rupee itself.

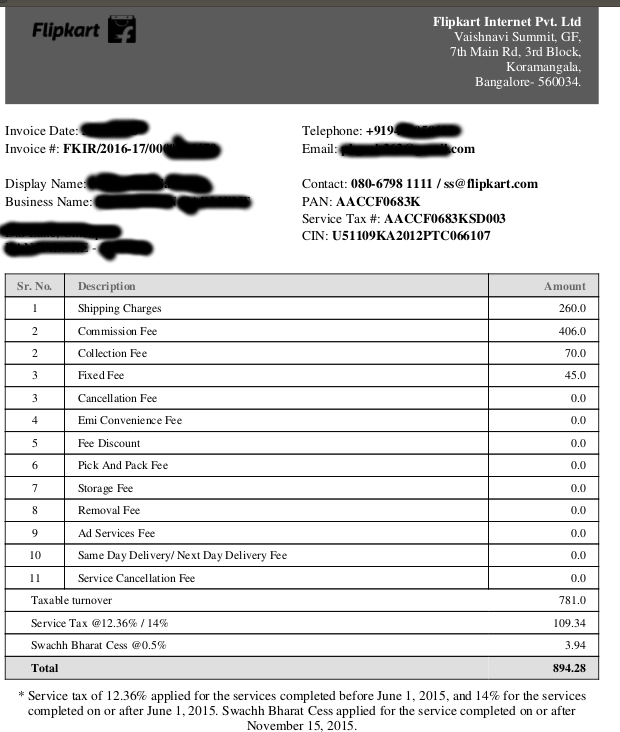

Let’s make payment of TDS with an example of Amazon and Flipkart Invoice

The calculation is as follows

| Flipkart | Amazon | |

| 194 C (2%) | Rs 5.2 (2% of 260) Shipping Charges | Rs 1972.6 (10% of 98630) Easyship Handling Fee |

| 194 H (10% before June 1st and 5% after that) | Rs 52.1 (10% of 521). Adding commission fee, collection fee fixed fee. | **Rs 20682.4 (10% of 206824.4). Adding Fixed Closing Fee, Listing Fee and Refund Processing Fee |

Service Tax and Swatch Bharat Cess and any other cess should not be added with the commission or Shipping Charges.

**Simplest way to get the commission amount on Amazon is to deduct “Easyship Handling Fee” from “Subtotal of fees amount“.

Rs 305454.44 – Rs 98630 = Rs 206824.4 (Commission Amount)

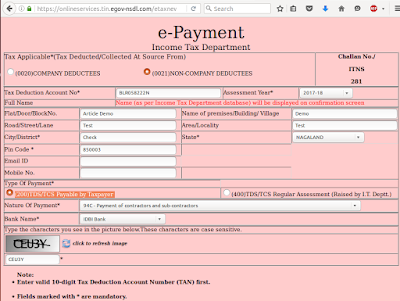

TDS Payment

Before making a payment make sure you have a TAN number. You can apply for TAN by going to the website https://tin.tin.nsdl.com/tan/ and make an online payment of Rs 63 + taxes. Your TAN number will be available within 10-15 days after you send the documents to the TAN department in Pune.

After you complete your TDS calculation click on this link here to make the payment.

Select ITNS 281. Select the following (0021)NON-COMPANY DEDUCTEES and (200)TDS/TCS Payable by Taxpayer.

Fill the remaining details accordingly. The Assessment year will be next of the financial year. For example we are paying TDS for 2016-17 then the assessment year will be 2017-18

You have to make separate payments for 194C and 194H. Select accordingly. Please note that you will not find 194C in drop down menu but 94C and 94H. You can make all the payments for each section together. In our case for 194 C we can combine Rs 5.2 and Rs 1972.6 and make a single payment.

TDS Penalty

TCS and GST

If there are any errors or misinformation please add in the comments section I will update them accordingly. If you are interested in knowing the Tally or account entries for TDS payment and adjustments let me know in the comments section, will write a separate article for it.

Do you wish to submit an article. Please fill our contact form here

Hello Sir,

Suppose I have started selling on Nov 2016

Fees for November 2016- 9000

Fees for December 2016- 5000

Fees for January 2017- 3000

Fees for February 2017- 2000

Fees for March 2017-4000

I have crossed my TDS threshold(Rs.15000) on January 2017. Do I need to pay TDS for November-March or from January-March?

Threshold limit does not mean exemption limit. You need to pay from Nov-March. From first rupee.

Please consider the same case with different scenario-

Suppose I have started selling on Nov 2016

Fees for November 2016- 9000

Fees for December 2016- 5000

Fees for January 2017- 3000

Fees for February 2017- 2000

Fees for March 2017-4000

I have crossed my TDS threshold(Rs.15000) on January 2017. But my total turnover was only 80 lakh(1st April 2016-31st march 2017) and I am a proprietorship firm. Will I still need to pay TDS?

No. As long as you were not under audit the previous year. That means if you have crossed 1 cr before this year you were audited and hence in this year even though your sale is 80 lakhs you are liable to pay. If you never were in audit then you need not pay.

Hi Rohit,

Thanks for the detailed article on TDS payments for e-commerce services. We recently started selling on Amazon India and have a couple of questions regarding the same:

1) We are an LLP firm, in this case, which option should we choose between (0021)NON-COMPANY DEDUCTEES and (0020)COMPANY DEDUCTEES.

2) At what stage in the payment process, we need to give amazon details? Under Address Section on the first page, should we give our company address or amazon address details?

Small observation:

In the calculation table you have shown the following:

“Rs 1972.6 (10% of 98630) Easyship Handling Fee”, guess you mean 2% and not 10%.

Thank you,

Vijay

Sir, Post GST Amazon and Flipkart are not issuing the above type of Invoices. Also Flipkart used to add TDS Calculation Sheet, post GST. Is it that Post GST we need not deduct TDS ?

SO TODAY WE SHOULD TAKE 5% RIGHT ON 194H AS IT IS AFTER 1.6.16 @5%, AND NOT 10%

Yes

how do we get back the TDS amount deducted back from the Ecommerce companies???

On flipkart you can submit your sealed and signed TDS certificate. You can see the option under support. For Amazon create a case and upload your certificate. Similarly you will find on other portals. If not just create a case and they will refund you.

I have GST in three different states done for the FBA, the commission and shipping is charged on all three state’s GST. Should I calculate the TDS amount considering all three invoices(invoice of each state)?

Yes you need to if all are under same PAN.