Beginner Series 1: Requirements to Sell online on Indian Marketplaces

Requirements to Sell online

More number of Indian consumer are purchasing online. With Internet penetration these numbers are growing everyday. This growth has opened the doors for individuals to showcase their products and sell online. Marketplaces such as Amazon, Snapdeal, Flipkart and others helps individuals achieve this. In the past few years the number of sellers on these platforms has gone up to 150000+. The e-commerce industry growth is projected to be 80 billion by 2020 so why be left behind.

You need to fulfil certain requirements when you register for these marketplaces . Few documents are mandatory and needs to be uploaded.

E-commerce registration requires the following

1) TIN/GST: Currently many sellers that sell non taxable products do not require a TIN number. The draft GST law clearly states that selling on e-commerce sites will require a GST registeration. You need to have a physical commercial location in order to avail GST/TIN number. If you are selling completely online and do not wish to take a physical space you can always apply for virtual offices. You can contact us to get a virtual office.

If your sales are up to 20 lakhs in a year then GST is not mandatory . E-commerce requires GST from the sale of first Rupee. Also note that the composition tax which is available for sales up to 50 Lakhs does not apply to e-commerce. Refer Section 9.1.d of GST draft law.

2) PAN: Permanent Account Number is a basic document that is required by all. Apply for a new PAN here

3) TAN: This is used for deducting TDS, it’s not mandatory if you are a proprietorship concern who is not under audit. GST will make TAN mandatory as TCS will be deducted by Marketplaces and filing needs to be done.

Apply a new TAN here

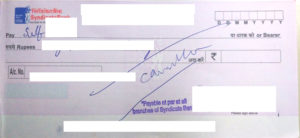

4) Bank Account cancel cheque: A cancel cheque in the name of the company. Please refer the image below.

It can be clearly seen that with GST implementation it will be difficult to sell individually. Many home makers, students and working professionals that use these platforms to earn something extra will no longer be able to sell without GST.

If you are planning to purchase/sell globally

5) IEC: Import Export Code. If you purchase from outside India or planning to sell outside then you need to quote IEC. Apply for IEC here

6) Credit Card: Many marketplaces require that you provide your credit card details. Globally marketplaces charge monthly subscription fees. Marketplaces deduct from your credit card if you do not generate sufficient sales to pay the fees. More on these in later articles.

Some other requirements

Digital signature: With the use of technology and to reduce dependency on physical signatures, digital or e-signatures are becoming mandatory. We require it while applying for IEC, TCS/TDS quarterly filing and Income Tax filing.

With these requirements satisfied you are ready to register on various marketplaces. In our next article we will cover how to register on Marketplaces.

Latest Comments